Financial Planning

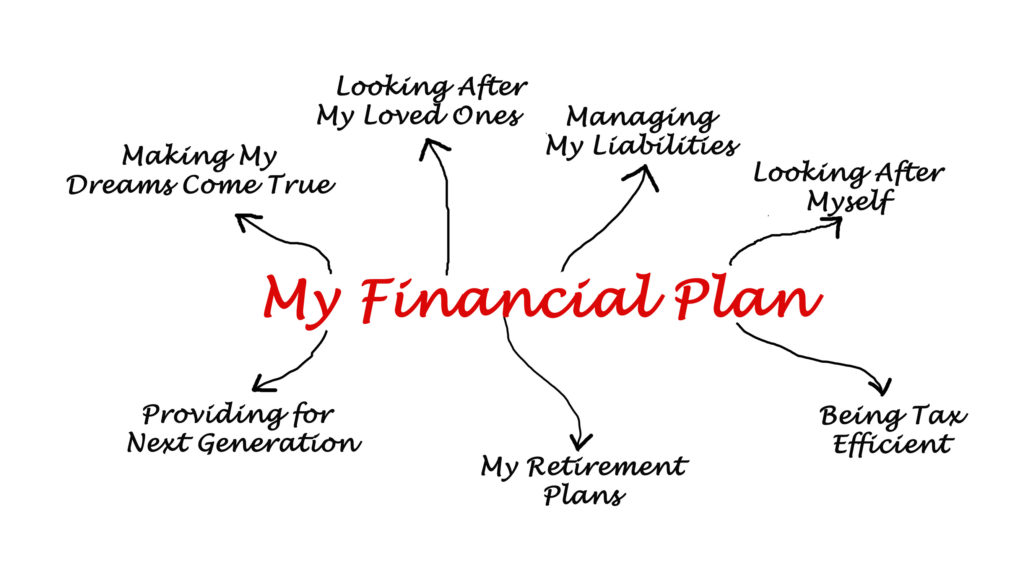

Financial planning takes the guesswork out of managing your finances and helps you understand the implications of each financial decision you make. Everyone has different goals, so it’s important to have an unique plan that works for you and your financial situation, both now and in the future.

Our goal is to help you reach your financial goals and maintain financial independence through a comfortable retirement. We can guide you through tough decision-making processes such as asset allocation, investment performance monitoring, student loan repayment plans, college education funding, retirement plans, insurance, tax, estate, and business succession planning.

Seeking help from a professional financial advisor can be beneficial if you:

- Want to better manage your financial life, but aren’t sure where to start

- Want a second professional opinion about the plan you’ve developed

- Lack time to do your own financial planning

- Lack expertise in certain areas such as investments, retirement planning, insurance, etc.

- Have an immediate need or unexpected life event

Our services include, but are not limited to:

- Wealth tracking

- Retirement planning

- Performance overview

- Education and major expense planning

- Estate planning

- Cash flow and debt management

Our Process

STEP 1

- We first get to know each other through your initial consultation.

- Discuss your unique life & financial goals.

- We discuss how Zagmout & Company CPAs can help.

- We both decide if we are a good fit to work together

STEP 2

- We will send you an engagement letter specifying our fees and services to be provided.

- We create your online client portal

- We will gather your digital or paper copies of your financial data

STEP 3

- Develop a strategy to achieve your financial goals and aspiration.

- We will conduct a stress test on your plan to analyze your:

- income and expenses

- viability of your retirement plan

- how long assets would last under multiple scenarios

- healthcare and long term care expenses

- Insurance gaps

- in addition to other factors

STEP 4

- Provide you with your Integrated Financial Statement, outlining your plan’s financial status.

- Share the findings with you and develop strategies to achieve your goals, and mitigate some of the planning gaps discovered during the analysis.

- Answer any questions you may have, and thoroughly explain your financial plan, and how it may affect you and your loved ones.

STEP 5

- Monitoring your progress via regular client check ups.

- Monitoring your progress via regular client check ups.

- Make the necessary tweaks to keep your financial plan current.