Tax Services

Zagmout & Company CPAs aims at reducing your taxes through meaningful & proactive tax planning and Compliance services for successful individual, businesses, non-profit organizations, as well as trust and estate.

Zagmout & Company CPAs strongly believe that it is in the planning where our clients receive the greatest value and not only at the point of return preparation.

Effective tax planning includes a focus on the structuring of the transactions and related personal/business events that drive tax results. It is certainly where we find our greatest satisfaction.

We Specialize in:

Individual Tax Preparation

Tax Accountants at Zagmout & Company work closely with executives, entrepreneurs, and multi-generational families to plan and implement solutions to reduce taxes and improve cash flow.

We possess the necessary expertise to guide you through the ever-changing rules and regulations.

Individual tax services include:

Tax return preparation

Stock option planning

Multi-State filing

U.S. Reporting of Foreign Assets and or Foreign Bank Accounts

Tax projections and year-end planning

Business tax Preparation

We develop tax-efficient strategies by looking for ways to help reduce your current and future tax burden for all types of business structures including corporation, S-corporations, partnerships, Limited Liability Companies (LLC) and sole proprietorships.

Business tax services include:

Business tax planning and preparation services

Cost segregation and depreciation planning

Excise taxes

Like-kind exchange planning

Tax projections and year-end planning

Non-Profit Organizations

We help mission-driven organizations navigate through unique challenges of financial reporting, tax compliance and operational improvement.

Non-profit services include:

Tax returns preparation

Financials statements preparation

Accounting personnel training

Operational efficiency

Formation filings

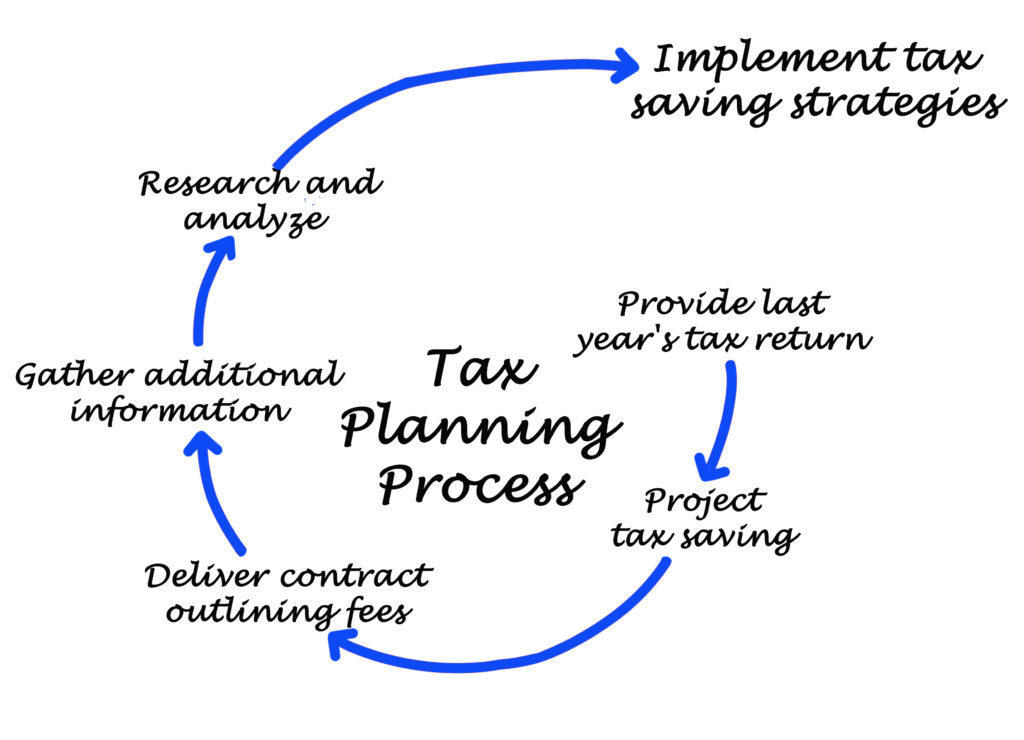

Our Process

STEP 1

- We first get to know each other through your initial consultation.

- Discuss your unique tax situation.

- We discuss how Zagmout & Company CPAs can help.

- We both decide if we are a good fit to work together.

STEP 2

- We will send you an engagement letter specifying our fees and services to be provided.

- We create your online client portal.

- You will upload your prior 3 years of tax return, and current year income data, and tax forms.

STEP 3

- We will review your prior year tax returns for completeness and accuracy.

- We will analyze your tax situation, and research proper deductions you are entitled to.

- Along the way we’ll reach out for input and additional info when necessary.

- After we finish preparing your tax return, it will then be reviewed for quality, accuracy, and completeness.

STEP 4

- We send you a draft return for your review and electronic signature.

- At this time we collect our preparation fees.

- Then, we-file returns on your behalf if it is eligible for e-filing; otherwise we will provide you with mailing instructions.

STEP 5

- Just because tax season is over, it doesn’t mean we are done.

- We will continue monitoring your tax situation throughout the year.

- We will help you determine the appropriate estimated quarterly tax payments.

- We will create a tax projection to give you an insight on how your next year return would look like.

- Have a tax question during the year? Give us a call!