New Tax Updates Affecting Your Tax Filing This Year

Most people vow to start the new year based on a strong financial position footing, and commitment to save more or spend less. This year some of tax changes could help achieve that goal. The IRS has made inflation adjustments to a range of key figures, from the amount you can put in a 401(k) retirement plan to the individual income tax brackets that help you determine your tax rate. We compiled a list of the GOOD, the BAD, and the UGLY changes that may positively or negatively impact your filing this year.

I. THE GOOD

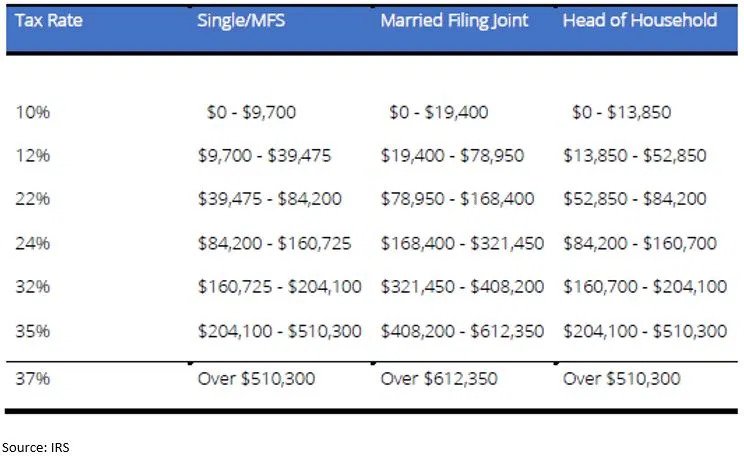

Here are your new tax brackets to be used for 2019 tax season.

The contribution limit for traditional and Roth individual retirement accounts is $6,000, plus another $1,000 for savers 50 and over. The IRS limits high-income earners’ ability to make direct contributions to Roth IRAs — accounts in which you can save after-tax dollars, have the money grow tax-free and use it in retirement free of taxes. For high earners, there are ways however to convert traditional IRAs to Roth by making a non-deductible contribution to traditional IRAs; a.k.a. back door Roth conversion. The math gets complicated if you do a partial conversion to Roth. Please contact us to determine if backdoor Roth conversion is beneficial to you.

Health savings opportunities

As of 2020, the IRS increased the contribution limit for the health savings account (HSA). These accounts allow you to make tax-deductible contributions to HSA accounts and have the money grow free of taxes. The funds can be withdrawn tax-free to cover qualified health expenses. This year, you can save up to $3,550 for individuals with self-only health coverage. That’s up from $3,500 in 2019. Account holders with family plans can save up to $7,100 in this account, up from $7,000 in 2019. Individuals over 55 years of age can add $1,000/year as a catch-up provision. HSAs differ from health-care flexible spending accounts primarily in that you can roll over the HSA balance from one year to the next. The money in FSAs generally must be used by the end of the plan year or you lose it. IRS relaxed the rule a bit, and now you can roll over up to $500 in unused funds in the following plan year. The IRS also increased the contribution limits to health-care FSA to $2,750 in 2020, up from $2,700 in 2019.

Gift and estate tax savings

The Tax Cuts and Jobs Act nearly doubled the amount that decedents can bequeath in death — or gift over their lifetime — and shield it from federal estate and gift taxes, which are 40%. For 2020, the lifetime gift and estate tax exemption was increased again. In 2020, the lifetime exemption is $11.58 million per individual, up from $11.4 million in 2019. Finally, the annual gift exclusion, the amount you can give to any other person without it counting against your lifetime exemption, remains unchanged at $15,000 for 2020.

Child tax credit

The child tax credit for children 16 and under is $2,000/child. The income threshold for married filing jointly is now $400,000 adjusted gross income (AGI) ($200,000 AGI for Individual filers). Older children & other dependents now qualify for a $500/dependent credit. Even if tax is at zero, $1,400 of each $2,000 credit is refundable.

II. THE BAD

These are the more familiar deductions which went away. Some of them will be missed.

- Personal Exemptions (reduced to zero)

- Casualty & Theft Losses (except federally declared disasters)

- Miscellaneous & Unreimbursed Employee Business Expenses

- ROTH Recharacterizations are now irreversible

- Kiddie Tax going from parent’s rate to Trusts rate, which is much higher.

- Moving Expenses (except active military)

- Home Equity Loan Interest is no longer deductible (unless for home improvement)

- College donations to purchase athletic tickets are no longer deductible

- Business Entertainment and country club dues (it appears business meals are okay)

- Alimony beginning on or after January 1, 2019 is no longer Income to the recipient or a Deduction to the payor

- The Affordable Care Act (ACA) Individual Mandate and the penalty is repealed in 2019

- $2 million exclusion on cancellation of debt for mortgage on residence (expired 2017)

- Mortgage Insurance Premium Deduction on Itemized Deductions (expired 2017)

III. THE UGLY

Identity theft protective measures

The Service and many states have come up with some helpful measures to protect taxpayer identity. The requirement for Drivers License information is mandatory for many states. The W-2 form only requires the “last 4 numbers” of the taxpayer’s SSN, not the entire number. If your address was changed along with your direct deposit bank information from the previous year, IRS now sends a letter to your prior address asking if you have or have not filed a tax return from this new address. If it’s being done by an identity thief, you simply check “No” and Fax it back to the IRS to suspend processing of the false return. Outsourced tax preparation?! Some accounting firms (mostly large ones) outsource the preparation of your tax return to subcontractors outside United States. In order to share that information such as social security number, date of birth information, and other sensitive information, the taxpayers have to consent to such disclosure. Client Disclosure and Consent. The IRS has recently added provisions to the Tax Code designed to provide added safeguards regarding the transfer and use of your personal tax return information.

If you have any questions regarding this article, or if you need further assistance regarding your unique financial or tax situation, send us an email at info@zagmoutcpas.com, or call us at (312) 239-3716.

To learn more, visit Zagmout & Company CPAs at www.zagmoutcpas.com.